Rollover!

How I helped my clients this week

During my time working as a financial advisor, I’ve realized there is a huge gap in our education system. No one teaches us about finance! I’ve made it my duty to fill this gap by providing financial education to my clients and friends. In an effort to demystify my line of work, in this edition of “The Blind Seer,” we’re going to talk a little about one of the more nitty-gritty tasks that occupies my time: Rollovers (hint: its not just a command you can give to a well-trained dog).

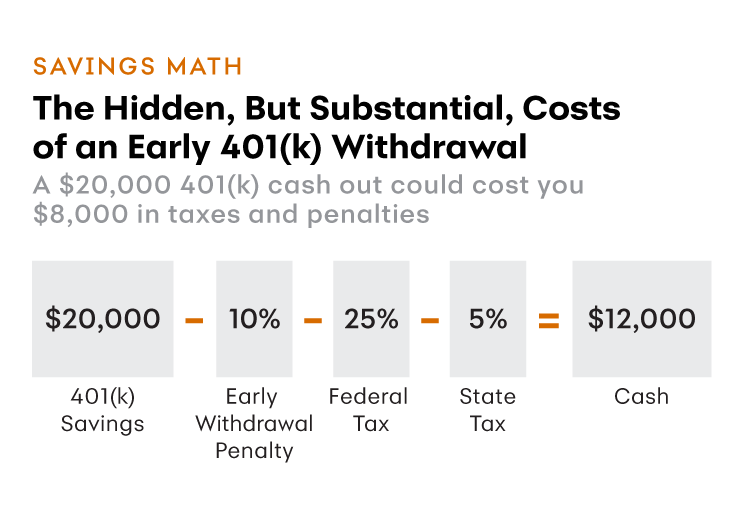

Lately, I’ve been processing a lot of rollovers for my clients. A rollover usually occurs when a person leaves a job where they had a 401(k). 401(k)s are considered “qualified money.” Certain steps need to be taken so that the funds do not lose their qualified status. In other words: you need to deposit the funds into a qualified plan (usually an IRA) or account within 60 days of withdrawing them. Otherwise, you may accidentally trigger taxes and penalties on those funds.

WHY YOU WANT TO DO A ROLLOVER WHEN YOU LEAVE YOUR JOB:

In short, its always wise to maintain full control over your money. You will be amazed to find out how much money you lose because of fees and poor investment options that are so often found in 401(k) plans. A word of caution: if you do a rollover, make sure you aren’t rolling over into another less-than-ideal plan. TFG creates plans that are the most beneficial to the client.

Need help rolling over an old 401k into a sparkling new IRA with TFG? Give us a call!

Got a hankering for further financial education? Subscribe now!